All Categories

Featured

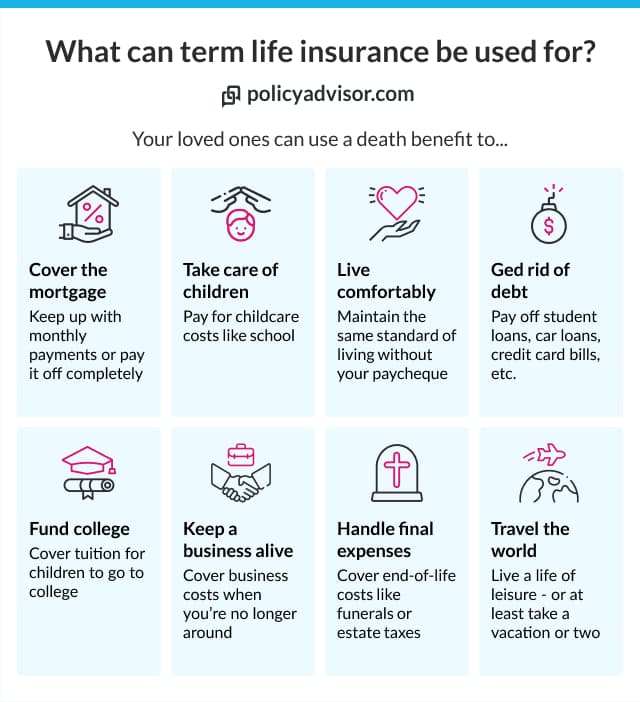

Think About Making use of the DIME formula: dollar stands for Financial obligation, Earnings, Home Mortgage, and Education. Total your financial debts, home loan, and university expenses, plus your income for the variety of years your family requires protection (e.g., till the youngsters run out your home), which's your coverage demand. Some economic experts determine the amount you need using the Human Life Value philosophy, which is your lifetime revenue possible what you're earning now, and what you expect to earn in the future.

One method to do that is to search for firms with strong Monetary stamina scores. term life insurance with chronic illness rider. 8A business that underwrites its own policies: Some companies can market policies from one more insurance provider, and this can include an added layer if you intend to transform your policy or in the future when your family needs a payment

Limited Term Life Insurance

Some firms offer this on a year-to-year basis and while you can expect your prices to increase considerably, it might deserve it for your survivors. One more way to compare insurance provider is by checking out online consumer testimonials. While these aren't likely to inform you much regarding a company's monetary stability, it can inform you exactly how simple they are to collaborate with, and whether cases servicing is a problem.

When you're more youthful, term life insurance policy can be a basic means to safeguard your liked ones. As life modifications your financial top priorities can also, so you may desire to have whole life insurance coverage for its life time coverage and extra benefits that you can make use of while you're living. That's where a term conversion comes in - level term life insurance advantages and disadvantages.

Authorization is ensured no matter your health. The premiums will not enhance when they're set, yet they will increase with age, so it's a great concept to lock them in early. Find out more regarding exactly how a term conversion works.

1Term life insurance policy supplies temporary protection for a critical duration of time and is normally cheaper than long-term life insurance policy. child term rider life insurance. 2Term conversion guidelines and restrictions, such as timing, might apply; as an example, there may be a ten-year conversion benefit for some items and a five-year conversion benefit for others

3Rider Insured's Paid-Up Insurance coverage Acquisition Alternative in New York. There is an expense to exercise this motorcyclist. Not all getting involved policy owners are qualified for returns.

Latest Posts

Increasing Term Life Insurance Policy

Funeral Insurance Rate

Credit Life Insurance Is Generally Blank______ Expensive Compared To Equivalent Term Life Insurance.